What’s Market in Canada, eh? A New Canadian Private Target M&A Deal Points Study

What’s Market in Canada, eh? A New Canadian Private Target M&A Deal Points Study

To help find a reasonable middle ground or to resolve a thorny point of negotiation in a share or asset purchase agreement, clients often will ask their merger and acquisition (“M&A”) lawyer: “What’s market”? However, the view of one deal lawyer may differ from the view of another and will be influenced by the lawyer’s own experiences, clients and negotiating acumen.

In 2008, the Mergers & Acquisitions Committee of the American Bar Association, Section of Business Law published its first Canadian Private Target M&A Deal Points Study.[1] That Study was the first-ever report on key deal terms in Canadian private company M&A agreements. The Study became an instant must-have tool for M&A lawyers, as it provided very useful, objective insights into Canadian market practices. The most recent study was released by the M&A Committee on December 19, 2019 (the “2019 ABA Study”).[2] The six Canadian studies, produced over an 11-year period, include historic trend information as well as useful comparisons in Canadian and United States deal practices (the ABA M&A Committee produces similar studies on United States private target M&A deal points). In this bulletin, we discuss some of the key takeaways from the 2019 ABA Study.[3]

Overview of the Study Sample

The deal points reported on in the 2019 ABA Study are derived from acquisition agreements filed on Canada’s System for Electronic Documents and Analysis and Retrieval (“SEDAR”) by Canadian reporting issuers who purchase private companies. The 2019 ABA Study reports on deals that were signed in 2016 and 2017, an overview of which is set out below:

| Number of Deals | 90 (53% in 2016, 47% in 2017) |

| Deal Size | Range C$5M to $2.65B >$5M – $25M – 34% >$25M – $50M – 14% >$50M – $100M – 12% >$100M – $200M – 7% >$200M – $500M – 18% >$500M – 11% Indeterminate – 3% |

| Form of Deal | Asset: 27% Share: 64% Mixed: 9% (includes amalgamation and plan of arrangement) |

| Form of Consideration | All cash: 49% All shares: 14% Mixed: 36% |

| Nature of the Parties – Principal Buyer | Corporate: 87% Private Equity: 6% Financial: 2% Entrepreneurial: 5% Indeterminable: 0% |

| Nature of the Parties – Principal Seller[4] | Corporate: 70% Private Equity: 9% Financial: 1% Entrepreneurial: 17% Indeterminable: 2% |

The 2019 ABA Study covers agreements with a purchase price of C$5 million or more; the largest being C$2.65 billion. Approximately 60% of deals were valued at C$100 million or less, and 34% had a deal value of less than C$25 million. The deal size distribution was similar in the 2016 ABA Study[5] (63% and 29%, respectively). US deal practice is quite different: Deals valued at US$100 million or less represented only 37% of the deals reported on in the most recent US private target deal points study.[6]

The targets principally operated in the Oil & Gas (21% of deals reported) and Industrial Goods & Services (14% of deals reported) industries, with Health Care, Media, Financial Services, Food and Beverages and Chemical and Natural Resources accounting for under 8% of deals each. The industry overview in the 2016 ABA Study is comparable, with the exception of Chemical and Natural Resources, which saw a noticeable drop from 17% to 4% of transactions reported. In the United States, the three principal industries as reported on in the most recent US study were Technology, Health Care and Industrial Goods & Services.

Deal Terms

The following sections detail some of the key deal terms reported on in the 2019 ABA Study.

Post-Closing Purchase Price Adjustments

Many purchase and sale agreements include a mechanism for the parties to estimate a financial metric, such as the working capital of the target business as of the closing date, and to make adjustment payments post-closing if the actual working capital turns out to be more or less than the estimated amount. Adjustments may also be calculated on other pre-determined financial metrics or earnouts, which are conditional on the future performance of the business being acquired.

Purchase price adjustment mechanisms were included in 79% of deals reported in the 2019 ABA Study, of which adjustments made on account of working capital were the most prevalent (found in 79% of deals that contemplated post-closing adjustments). In 59% of cases (down from 76% in the 2016 ABA Study), the buyer prepared the closing balance sheet.

Another noticeable shift is found in the methodology for preparing the closing balance sheet. In the 2016 ABA Study, the closing balance sheet was most often prepared in accordance with GAAP consistent with past practices of the target (38% of deals). Conversely, this figure fell by 20% in the 2019 ABA Study. GAAP (32%) and other methodologies (37%) are now the most popular approaches.

Material Adverse Effect (“MAE”) Qualifier

A prescribed MAE standard can be used to qualify reps and warranties or to construct a condition of closing. A not uncommon definition of an MAE is “any result, occurrence, fact, change, event or effect that has, or could reasonably be expected to have, a materially adverse effect on the business, assets, liabilities, capitalization, condition, results of operation or prospects of the target”.

MAE qualifiers are pervasive in Canada and the United States. The 2019 ABA Study reported that 92% of deals contained this qualifier. Canada is evidently following the trend in the US where 100% of deals reported on in the most recent US study had an MAE qualifier. Generally, this qualifier is defined (applicable in 82% of deals in the 2019 ABA Study) and includes forward-looking standards, such as “could reasonably be expected to have” (true of 69% of the 2019 ABA Study deals).

Although less common, MAE definitions may sometimes include conditions that have a materially adverse effect on the seller’s ability to close (found in 35% of deals). It is, however, common to include carve outs from a MAE definition. Changes in the economic conditions, changes in law and change in the industry conditions are the most common carve-outs reported in the 2019 ABA Study.

Representations and Warranties

Representations and warranties are factual statements typically made about the shares, assets, and business that are being purchased, and the liabilities that are being assumed. They provide disclosure to a buyer and are a means to allocate risk about unknown matters between the parties.

(a) No Undisclosed Liabilities

There are several formulations of a “no undisclosed liabilities” representation. A buyer-favourable formulation could state that the target company has no liabilities except for liabilities reflected or reserved against in the target’s balance sheet and liabilities incurred by the target in the ordinary course of its business since the balance sheet date. A more seller-friendly formulation might limit the rep to liabilities of the nature required to be disclosed in a balance sheet, since businesses often will have liabilities that are not reported (and not required by accounting standards to be reported) in the financial statements.

According to the 2019 ABA Study, 79% of deals included some form of no undisclosed liability representation. This reflects a steady decline in the use of the representation (a drop from 90% in 2014). In the majority of reported deals in the 2019 ABA Study (74%), a buyer-favourable formulation of the representation was used and in most deals (88%), the representation was not qualified by knowledge.

(b) Compliance with Laws

In a “compliance with laws” representation, the seller represents and warrants that the business is being (and has been) conducted in compliance with applicable laws. Points of negotiation often centre around the period covered (i.e. current or past compliance) and exceptions or limitations to the representation (such as for environmental matters, which often are dealt with in a standalone representation). The representation is also sometimes qualified by knowledge or materiality.

The 2019 ABA Study reported that substantially all deals include a compliance with law representation (89%), and in only a relatively small percentage of deals is the representation qualified by knowledge (12%).

(c) “10b-5”/Full Disclosure

The “10b-5” and full disclosure representation serves as a catchall safety net for the buyer. The “10b-5” representation is based on Rule 10b-5 of the United States Securities Exchange Act of 1934. A typical formulation of the “10b-5” rep is a statement by the seller that no representation or warranty or other statement made by the target in the acquisition agreement contains any untrue statement of a material fact or omits to state a material fact necessary to make the statements contained in the agreement not misleading. The full disclosure representation typically includes a statement by the seller that the seller does not have knowledge of any fact that has specific application to the seller and that may materially adversely affect the assets, business, prospects, financial conditions or results of operations of the target that has not been set forth in the agreement or the disclosure letter.

The 2019 ABA Study reports that some variation of the “10b-5” and full disclosure representation was included in only 39% deals. When included, the usage of the “10b-5” formulation on its own was the most common approach. The Canadian practice seems to be quite different than in the US. According to the most recent US study, a “10b-5” or full disclosure representation was included in only 17% of deals. The “10b-5” formulation was most prevalent.

Conditions to Closing

The 2019 ABA Study’s findings on conditions to closing in deferred closing deals (i.e. sign and then close) are discussed below.

(a) Accuracy of Target’s Representations

The 2019 ABA Study examines the standard versions of the condition that requires the target’s representations and warranties to be accurate at various points in time and to a varying degree. In terms of timing, representations and warranties must be accurate either as of the date of closing only (found in in 46% of deals reported in the 2019 ABA Study), as of the date of closing and at signing (51%) or at signing only (3%). The inclusion of materiality qualifiers determines the degree of accuracy of the representations and warranties, as set out below:

Accuracy of Target’s Representations –

How Accurate Must They Be?[7][8],[9],[10]

“Bring Down”

“Bring Down”

(i.e., at closing)[11],[12]

(b) Buyer’s Material Adverse Change (“MAC”) Condition

The inclusion of a MAC condition allows the buyer to terminate the agreement if a material adverse change occurs following the date that the agreement was signed and/or the balance sheet date. Some form of this condition is included in 87% of deals reported in the 2019 ABA Study.

(c) No Legal Proceedings Challenging the Transaction

Parties may include as a condition of closing that there will not be any pending (or threatened) action, suit or similar legal proceeding brought by any government entity or third party challenging or seeking to restrain or prohibit the closing of the transaction. The use of this type of provision has historically remained high (found in 86% of deals in the 2019 ABA Study and over 90% of deals in the 2014 and 2016 ABA studies), and when used, the predominant requirement is for there to be no legal proceeding of any kind. The alternative is to limit this condition to government legal proceedings only.

(d) Legal Opinions

Only 18% of deals in the 2019 ABA Study required a legal opinion as a condition to closing. This requirement has fallen out of fashion in the M&A context, however it is still widely used on the financing side of acquisitions. Canadian standard practice is, therefore, trending towards the United States approach of not requiring a legal opinion on private company deals (only 3% of US deals required a legal opinion according to the most recent US private target deal points study).

Indemnification Provisions

Indemnification is a contractual remedy and risk allocation mechanism that is used to address certain post-closing issues and losses. Since these provisions are among the most heavily negotiated parts of an acquisition agreement, it is not surprising that deal point studies focus in large part on their application.

(a) Sandbagging

Buyers in private company M&A transactions often want to include a “pro-sandbagging provision” to expressly preserve their right to bring indemnification claims against the seller for breach of a representation, warranty or covenant, even if the buyer knew about the breach before closing and proceeded with closing the deal anyway. In other words, the buyer could decide to complete the acquisition knowing about a specific problem, and then proceed to “sandbag” the seller for recourse post-closing. Sellers often try to exclude the sandbagging provision or include an anti-sandbagging provision which limits the buyer’s ability to seek recourse in respect to matters which the buyer knew about at closing. The prevalence of sandbagging provisions in the 2019 ABA Study is set out below:

The use of anti-sandbagging provisions is lower (albeit marginally) in the 2019 ABA Study than it was in previous iterations of the deal point studies. This is consistent with the approach in the United States where anti-sandbagging clauses are very uncommon (only 4% of deals).

No Canadian court has considered whether a buyer can sue and recover its losses for breach of a representation if it knew of the breach when it closed on the transaction. The prevailing view of commentators is that a buyer can recover absent unusual circumstances, therefore, a purchase and sale agreement that is silent on sandbagging is the functional equivalent to an express pro‑sandbagging clause.

(b) Express Non-Reliance

Express non-reliance provisions are an acknowledgment by the buyer that it is not relying on any representations or warranties whatsoever regarding the subject matter of the agreement, express or implied, except for those representations and warranties expressly set out in the agreement. The 2019 ABA Study reported that 30% of deals included an express non-reliance provision – this reflects a steady decrease from prior studies (32% in 2016 and 43% in 2014).

(c) Survival/ Time to Assert Claims

The survival period in an M&A agreement is the time during which the parties may assert a claim for indemnification for an incorrect representation or warranty (or breach of covenant in some cases). The duration of the survival period is a key issue in almost all private M&A transactions. Buyers generally prefer long survival periods to ensure recourse regardless of when an issue arises, whereas sellers naturally push for a shorter period. The survival periods reported in the 2019 ABA Study were as follows:

Survival Periods

| Length of Time | % of Deals |

| Less than 12 Months | 2% |

| 12 months | 16% |

| > 12 to < 18 months | 4% |

| 18 months | 31% |

| > 18 to < 24 months | 1% |

| 24 months | 22% |

| > 24 months | 3% |

| Silent | 6% |

It is not common for these general survival periods to be more than 24 months and the popularity of deals with survival period that extend past 24 months has gradually fallen since the ABA first stared reporting on Canadian deal trends. It is not surprising that 18 months has been and continues to be the most popular option since this amount of time enables a buyer to conduct the business through one complete financial year and related audit cycle, which typically is enough time to uncover any significant issues with the business.

Certain representations and warranties may be carved out from these general periods in order to survive for other (typically longer) specified periods. The most common carve-outs are for fraud, taxes and due organization representations.

(d) Types of Damages/Losses Covered

Acquisition agreements may describe the types of damages/losses that can and cannot be claimed by an indemnified party. The deal point studies specifically focus on incidental, consequential and punitive damages.

The 2019 ABA Study reported that more than 99% of deals expressly defined recoverable damages. Incidental damages are expressly excluded in 23% of deals and consequential damages are excluded in 47% of deals. Punitive damages are expressly excluded in the highest number of deals (51%).

(e) Indemnity Baskets

An indemnity basket is a threshold amount of losses that a party must suffer before it is entitled to any indemnification from another party. The following types of indemnity baskets are common in M&A transactions:

(1) A tipping (or first-dollar) basket provides that once a party has incurred losses equal to the agreed amount, that party is entitled to full recovery of all losses, from the first dollar.

(2) A deductible basket provides for recovery only to the extent that losses exceed a specified amount, called the deductible.

(3) A partial tipping basket is a hybrid form combining a tipping basket with a true deductible, under which a party can recover some but not all of the losses equal to the basket amount.

The 2019 ABA Study reported that tipping baskets were found in 44% of deals, followed by deductibles (30%) and partial tipping baskets (7%). 19% of deals did not have any basket. There has been an increase in deals where no baskets being used, and as a corollary to this trend, the use of deductibles and tipping baskets are at historical lows. Partial tipping baskets have remained the least popular approach.

The vast majority of deals continue to have baskets that are equal to or less than 1% of the total transaction value – this is true in 73% of deals in the latest deal points study. The most commonly observed basket sizes in deal point studies have historically been between 0.5% and 1% of deal value and 0.5% or less of deal value, in fairly equal proportions. In our experience with private M&A transactions, the basket often falls somewhere between a transaction value of 0.5% to 1.0%.

Indemnity baskets are applied to seller/target representations, warranties, covenants and other indemnified matters to a varying degree:

Baskets – General Coverage

(Subset: deals with baskets)[13]

(f) “Double Materiality” Scrape

M&A agreements increasingly include a “double materiality” scrape – this means that materiality and MAE qualifiers in representations and warranties are disregarded for all indemnification related purposes or for the calculation of damages. A “double materiality” scrape was included in 42% of deals covered in the 2019 ABA Study – this marks a significant increase from only 11% in the 2014 study. In 65% of deals with a double materiality scrape, the scrape was limited to calculation of damages only. By contrast, this limitation was non-existent in any deals reported in the 2014 ABA Study, therefore there is an evident rise in its use.

(g) Indemnity Caps

An indemnity “cap” is the upper limit of a party’s financial obligation to indemnify another party for its losses in the event a representation or warranty is untrue or a covenant is breached. When negotiating an indemnification cap, a seller will want the lowest cap possible, while a buyer will seek a high cap or no cap at all. Carve-outs, such as for breach of fundamental representations, are usually subject to an increased cap, or no cap at all. Indemnity caps continue to be present in most deals covered in the deal point studies.

Where deals have determinable caps, the 2019 ABA Study contains the following data as to their size:

Indemnity as % of Transaction Value

| Percentage of Deals with Determinable Caps |

Cap as % of Transaction Value[14] |

| 16% | Less than 10% of the purchase price |

| 7% | 10% of the purchase price |

| 11% | More than 10% and up to 15% of the purchase price |

| 11% | More than 15% and up to 25% of the purchase price |

| 23% | More than 25% and up to 50% of the purchase price |

| 7% | More than 50% but less than 100% of the purchase price |

| 25% | Purchase price |

The most significant deviation from the 2016 ABA Study is a jump from 7% to 16% in deals where the cap is more than 10% of the purchase price. It remains to be the case that the greatest number of deals have cap sizes that are between 25% to 50% of the purchase price or equal to the purchase price. Caps tend to be much higher in Canada than in the United States, where a cap equal to the purchase price is unusual. However, the Canadian practice might be moving towards the United States approach.

(h) Indemnification as Exclusive Remedy

As reported in most deals in the 2014, 2016 and 2019 deal point studies (74%, 70% and 67%, respectively), the indemnification right is the exclusive remedy available to the parties. Where that has been the case, intentional misrepresentations, equitable remedies, fraud, breaches of covenants and willful breaches are carved out from the exclusivity limitations to varying degrees.

(i) Escrows and Holdbacks

Escrow funds are often held by a third party escrow agent and distributed in accordance with the terms of an escrow agreement to satisfy adjustments to the purchase price and/or any indemnification claims made by the buyer against the seller. Similarly, a holdback is a mechanism used by the buyer to withhold payment of a portion of the purchase price at closing until a future condition is satisfied. The amount of the escrow or holdback and whether the amount is to be the sole source of indemnity for any incorrectness in or breach of a representation or warranty or breach of a covenant can be a key negotiation point in private M&A transactions.

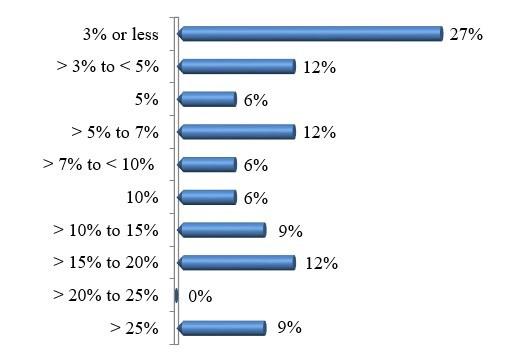

The 2019 ABA Study reported that 60% of deals with survival provisions had an escrow or holdback mechanism – this has nearly doubled from the time of the 2014 ABA Study to the 2019 ABA Study. The 2019 ABA Study includes the following breakdown of escrow amounts as a percentage of deal value:

Escrows/Holdbacks as a % of Deal Value

(Subset: deal with determinable escrow/holdbacks)

There has been considerable fluctuation with this data set over time, therefore no clear historical trends are apparent.

(j) Standalone Indemnities

Acquisition agreements will also typically include indemnification obligations for specific items irrespective of breaches of representations and warranties. Tax-related matters are the most common identifiable standalone indemnity – they are specifically indemnifiable in over 50% of deals in each deal point studies. Unpaid seller transaction expenses, employee benefits and environmental obligations are also covered, but to a lesser degree.

Observations

The 2019 ABA Study should be read and used carefully, with a good appreciation of the basis for the report. The underlying agreements reviewed are filed by public companies who purchased a private company. Hundreds of deals are done every year by private parties (including private equity firms) and the agreements for those deals are never filed, so we do not have the benefit of knowing “what’s market” for those deals. Furthermore, final deal terms will always be influenced by the relative bargaining position and leverage of the parties, and the increased use of rep and warranty insurance is expected to affect many of the key terms in M&A deal documents.

by John Clifford, Mikolaj Niski, Rima Halabi, Articling Student

[1] American Bar Association, M&A Market Trends Subcommittee of the Mergers and Acquisitions Committee, 2008 Canadian Private Target Mergers & Acquisitions Deal Points Study (American Bar Association, 2008). John Clifford chaired the working group of Canadian M&A lawyers who produced the 2008, 2010 and 2012 studies and has remained actively involved on the working groups for subsequent studies.

[2] American Bar Association, M&A Market Trends Subcommittee of the Mergers and Acquisitions Committee, Canadian Private Mergers & Acquisitions Deal Points Study (Transactions signed in 2016 and 2017) (American Bar Association, 2019).

[3] This bulletin also makes specific references to previous ABA Canadian Private Target M&A Deal Points Studies released in 2012, 2014 and 2016 (the “2012 ABA Study”, the “2014 ABA Study” and the “2016 ABA Study”, respectively).

[4] Counted as both corporate and private equity when sellers were composed of both groups.

[5] The 2016 ABA Study reported on deals that were signed in 2014 and 2015.

[6] American Bar Association, M&A Market Trends Subcommittee of the Mergers and Acquisitions Committee, Private Mergers & Acquisitions Deal Points Study (Including Transactions from 2018 and Q1 2019) (American Bar Association, 2019).

[7] This deal point considers the general standard applicable to accuracy of representations and does not account for the standard applicable to carved out reps.

[8] Includes deals with both “when made” and “bring down” requirements.

[9] Includes deals that use a formulation such as “representations and warranties that are qualified by materiality must be accurate in all respects and all other representations and warranties must be accurate “in all material respects”.

[10] e.g. “Each of the representations and warranties made by the Target in this Agreement shall be accurate in all respects… except for inaccuracies of representations and warranties the circumstances giving rise to which, individually or in the aggregate, do not constitute and could not reasonably be expected to have a Material Adverse Effect.

[11] Includes deals with both “when made” and “bring down” requirements and deals solely with a “bring down” requirement.

[12] Includes deals that use a formulation such as “representations and warranties that are qualified by materiality must be accurate in all respects and all other representations and warranties must be accurate “in all material respects”.

[13] “Other” includes deals with baskets that cover one or both of reps/warranties and covenants as well as other specified indemnity items, but less than all indemnified matters.

[14] Does not take into account cap carve-outs.

A Cautionary Note

The foregoing provides only an overview and does not constitute legal advice. Readers are cautioned against making any decisions based on this material alone. Rather, specific legal advice should be obtained.

© TRC-Sadovod LLP 2020

Insights (5 Posts)View More

Corporate Counsel CPD Webinar | Essential Leadership Practices: Supporting the resilience, engagement, and impact of your team

Join professional coach and certified stress management educator, Marla Warner, for an engaging program that will help you focus on elevating performance outcomes, while supporting your team’s engagement and wellbeing. You will learn how to foster trust and respect in your team, the benefits of “coaching”, and why gratitude, empathy and compassion are the superpowers for leaders in 2023 and beyond.

TRC-Sadovod’s Employment and Labour Webinar 2023

Join us for TRC-Sadovod's annual Employment and Labour Webinar as we review and discuss current trends, emerging employment legal issues and provide practical solutions to help you manage your workforce.

Enforcing Arbitration Agreements: Ontario Superior Court Raises a ‘Clause’ for Concern

This bulletin discusses a recent decision that found that an arbitration clause that contracts out of applicable employment standards legislation is invalid.

Transparency for Talent: Proposed Legislation Would Mandate Salary Range and Artificial Intelligence Disclosure in Hiring Process

Ontario will propose legislation aimed at providing additional transparency to Ontario workers, including salary ranges and use of artificial intelligence.

Environmental Obligations Trump Lenders: The Trend Continues

Re Mantle Materials Group, Ltd continues a recent trend in Alberta in which environmental remediation obligations are found to have a super priority.

Get updates delivered right to your inbox. You can unsubscribe at any time.