CBSA’s Proposal to Modernize the Valuation for Duty Regulations

CBSA’s Proposal to Modernize the Valuation for Duty Regulations

E-commerce has gained traction over the course of the COVID-19 pandemic and shows no sign of slowing down. From February 2020 to July 2022, retail e-commerce increased by 67.9% in Canada.[1] This increase in e-commerce has reduced the use of brick-and-mortar stores and also expanded the participation of non-resident importers in cross border transactions.

The CBSA has proposed amendments to the value for duty (“VFD”) rules, which are used to determine duty payments, and according to the CBSA currently favour non-resident importers in certain circumstances.[2] However, the proposed amendments, as drafted, have effects that extend beyond non-resident importers.

It is important to consider how the current regulatory framework and the proposed changes may impact your business. Any interested parties and relevant stakeholders may choose to provide their written comments on the draft regulations during the consultation period which concludes June 26, 2023.

Canada’s Legislative (Lack of) Definitions Lead to Lower VFD Assessment

The World Trade Organization’s (“WTO”) Customs Valuation Agreement establishes a number of principles to evaluate the customs value of all goods entering WTO countries (including Canada) which are assessed in a hierarchical order. The Customs Valuation Agreement includes an important obligation imposed on WTO members to use the Transaction Value Method when determining the VFD of imported goods whenever possible which is based upon the price paid or payable for the goods.

Under the Customs Act in Canada, the Transaction Value Method is applicable when:

- the imported goods are sold for export to Canada;

- the purchaser in the sale for export is the purchaser in Canada; and

- the price paid or payable for the goods can be determined.[3]

The first two elements are impacted by the proposed changes. The World Customs Organization has advocated for a broad interpretation of the term “sale” meaning not only sales contracts, but also purchase commitments, purchase orders, intents to purchase or any other agreement that causes goods to be imported to Canada. It has also agreed that the last sale to the buyer in the importing country, and not an earlier sale, should be used as a basis for determining the VFD, often referred to as the “last sale rule”. However, this is not the case in all member countries; most notably, the first sale rule is used in certain cases for imports into the U.S.[4]

The term “sold for export to Canada” is not defined in the Customs Act; however, the Supreme Court of Canada established a narrow interpretation of “sold for export to Canada”: the sale by which title to the goods passes to the importer.[5] As a result of this decision, the last sale rule does not apply in every case due to the nature of international commerce and the complexities of global supply chains.

Additionally, a decision of the Canadian International Trade Tribunal exposed an ambiguity in the definition of the term “purchaser in Canada” which permits a sale between a foreign seller and a non-resident importer, essentially a foreign sale, to be used as the VFD, rather than the “last sale” to a permanent establishment in Canada.[6]

Proposed Amendments to the Customs Act

On May 29, 2023, the CBSA released an announcement proposing modifications to the Valuations for Duty Regulations. The proposals include a definition for “sold for export to Canada” and amend the current definition of “purchaser in Canada”. The modifications are not yet in effect and stakeholders may provide their input on the proposed amendments during the 30-day consultation period concluding on June 26, 2023.

In previous consultations in 2021, stakeholders were concerned that these amendments would be retroactive in nature. However, the CBSA has confirmed that these amendments would not be imposed retroactively.[7]

Proposed Definition of “Sold for export to Canada”

Under the proposed changes, “sold for export to Canada” will mean:

“in respect of goods, to be subject to an agreement, understanding or any other type of arrangement — regardless of its form — to be transferred, in exchange for payment, for the purpose of being exported to Canada, regardless of whether the transfer of ownership of the goods is completed before or after the goods are imported”.

The amendments also affirm that the “last sale” rule applies, specifying that where goods are subject to two or more agreements “the last transfer of the goods in the supply chain” is the applicable agreement for “sold for export to Canada”.[8]

Proposed Definition of “Purchaser in Canada”

The other proposed amendment removes the “permanent establishment” and “resident” components of the definition of “purchaser in Canada”.[9] Under the proposed definition the “purchaser in Canada” is:

“in respect of goods that are the subject of an agreement, understanding or any other type of arrangement referred to in section 2.01, the person who, under that agreement, understanding or arrangement, purchases or will purchase the goods, regardless of whether the person is the importer of the goods or when the person makes payments in respect of the goods” (emphasis added)

This definition shifts the emphasis away from who is a “resident” or who has a “permanent establishment in Canada.” Instead, it works in concert with the definition of “sold for export in Canada” and simply focuses on who the purchaser is in the last sale.

The Definitions in Practice

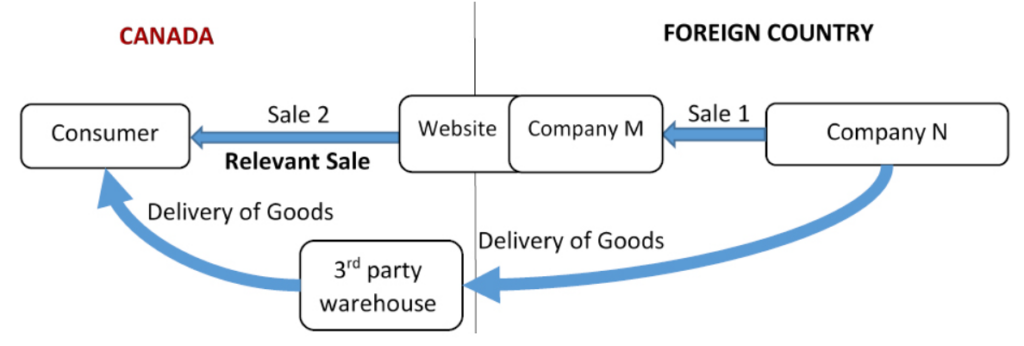

For instance, as in the illustration below, a consumer in Canada places an order online through company M’s website and pays for the goods. Company M, located in a foreign country, then places an order with company N, also located in the foreign country, to fill the order. The goods are the subject of two sales: (1) from company N to company M, and (2) from company M to the consumer.

Both sales are considered to have occurred prior to importation. Based on the proposed definitions, there is no analysis of who is importer of record or when the transfer of title to the goods occurred. Instead, Sale 2, from company M to the Canadian consumer, is the sale that causes the goods to be exported to Canada and is the last sale in the supply of the goods to Canada. Thus, under the proposed definitions, sale 2 would be considered the sale for export to Canada and would be used to determine the transaction value of the imported goods.

Conclusion

The rise of e-commerce and corresponding impact on brick and mortar stores has changed the way Canadians do business. The proposed amendments mark a modernization effort for customs regulations which is far-reaching in effect on importers, especially those faced with significant duty rates on their imports.

Any interested parties and relevant stakeholders are encouraged to provide their written comments on the draft regulations until June 26, 2023. TRC-Sadovod’s International Trade Group is available to assist with any specific advice on how the proposed amendments may impact your business.

[1] CBSA News Release: CBSA Proposes Changes to Regulations to Protect the Competitiveness of Canadian Businesses (May 29, 2023).

[2] Canada Border Services Agency, “Regulations Amending the Valuation for Duty Regulations” (27 May 2023) Canada Gazette, Part I, Vol. 57, No. 21 [Proposed Regulations], see the Regulatory Impact Analysis Statement.

[3] Customs Act, RSC 1985, c. 1, s. 48(1).

[4] U.S. International Trade Commission, Use of the “First Sale Rule’ for Customs Valuation of U.S. Imports (2009) USITC Publication 4121, Investigation No. 332-505.

[5] Canada (Deputy Minister of National Revenue) v Mattel Canada Inc., [2001] 2 SCR 100.

[6] Ferragamo USA Inc. v President of the Canadian Border Services Agency (21 March 2007), AP-2005-053.

[7] See Proposed Regulations under “Regulatory development – Consultation”.

[8] Proposed Regulations, 2.01(2).

[9] See section 2.1 of the Valuation for Duty Regulations, SOR/86-792.

by Jonathan O’Hara, William Pellerin, Peter Jarosz, Tayler Farrell and Courtney Aucoin (Summer Student)

A Cautionary Note

The foregoing provides only an overview and does not constitute legal advice. Readers are cautioned against making any decisions based on this material alone. Rather, specific legal advice should be obtained.

© TRC-Sadovod LLP 2023

Insights (5 Posts)View More

Ontario Court of Appeal Upholds 30-Month Notice Period

Ontario’s Court of Appeal has upheld an astounding 30-month notice period awarded to a non-managerial employee with almost 40 years of service.

Corporate Counsel CPD Webinar | Essential Leadership Practices: Supporting the resilience, engagement, and impact of your team

Join professional coach and certified stress management educator, Marla Warner, for an engaging program that will help you focus on elevating performance outcomes, while supporting your team’s engagement and wellbeing. You will learn how to foster trust and respect in your team, the benefits of “coaching”, and why gratitude, empathy and compassion are the superpowers for leaders in 2023 and beyond.

TRC-Sadovod’s Employment and Labour Webinar 2023

Join us for TRC-Sadovod's annual Employment and Labour Webinar as we review and discuss current trends, emerging employment legal issues and provide practical solutions to help you manage your workforce.

Enforcing Arbitration Agreements: Ontario Superior Court Raises a ‘Clause’ for Concern

This bulletin discusses a recent decision that found that an arbitration clause that contracts out of applicable employment standards legislation is invalid.

Transparency for Talent: Proposed Legislation Would Mandate Salary Range and Artificial Intelligence Disclosure in Hiring Process

Ontario will propose legislation aimed at providing additional transparency to Ontario workers, including salary ranges and use of artificial intelligence.

Get updates delivered right to your inbox. You can unsubscribe at any time.